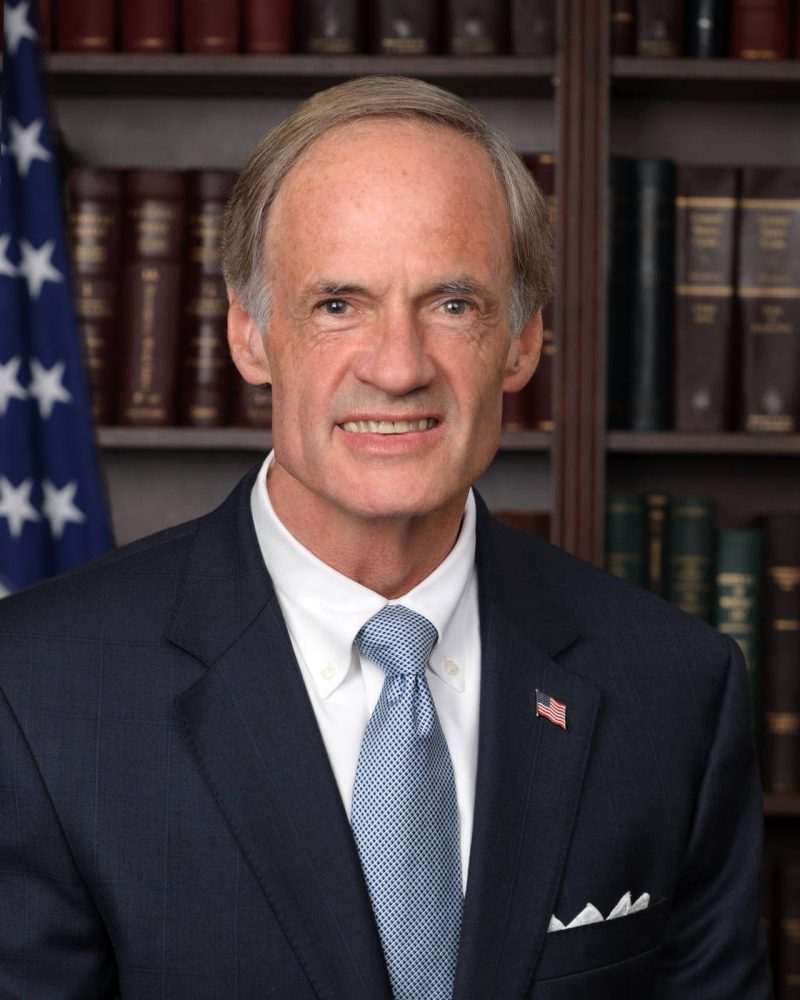

In response to volatile price fluctuations in Renewable Identification Number (RIN) prices in recent years, U.S. Sen. Tom Carper (D-DE) led a bipartisan, bicameral call for the Federal Trade Commission (FTC) to investigate and act on potential market manipulation on Tuesday.

Administered as credits for compliance with the EPA’s Renewable Fuel Standard (RFS) program, RIN prices have “fluctuated wildly” over the last four years, spiking 200 percent earlier this year alone, Carper wrote in a letter to FTC Acting Chairwoman Maureen Ohlhausen.

“This price volatility creates great uncertainty for obligated parties, especially for merchant refineries like the ones along the East Coast that have limited capability to blend biofuels into their products and need RINs to comply with the RFS program’s requirements,” the letter states. “East Coast refineries already face slim profit margins, in part, due to their dependence on international markets for crude feedstocks, high gasoline inventories and the competition they face from global refiners. Volatility in the RIN market only adds to the East Coast refineries economic concerns.”

The biofuel and the refining industries have raised concerns about RIN market manipulation in the past, but there has been “little collaboration between the agencies” to crackdown on responsible parties, the letter states.

“RIN market manipulation hurts all parties and directly harms our constituents,” the letter concludes. “That is why we urgently request that the Federal Trade Commission use its authority to address RIN market manipulation.”