On Friday, the U.S Treasury Department and the Internal Revenue Service (IRS) announced the release of a set of final rules for clean vehicles and the battery supply chain.

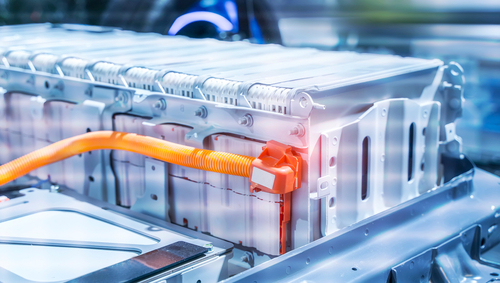

The rules, which clarify issues raised from the Inflation Reduction Act (IRA), will enhance investment in the clean vehicle and battery supply chain, officials said, by lowering costs for consumers and strengthening energy security through the building of resilient supply chains. Since 2022, the private-sector has investment $173 billion into the clean vehicle and battery supply chain, officials said.

“Today’s actions from Treasury and DOE provide clarity and certainty to an EV marketplace that’s rapidly growing,” John Podesta, Senior Advisor to the President for International Climate Policy, said. “The direction we’re headed is clear—toward a future where many more Americans drive an EV or a plug-in hybrid and where those vehicles are affordable and made here in America.”

The final rules provide definitions and guidance on taxpayer and vehicle eligibility for the new clean vehicle and used clean vehicle tax credits. The rules also cover requirements for transferring to dealerships the 30D clean vehicle credit of up to $7,500 and 25E used clean vehicle credit of up to $4,000. Officials said researchers found that consumers were more interested in an immediate rebate at the point of sale, than in a rebate when they file taxes. So far this year, officials said, more than 100,000 credits have been transferred for a total of more than $700 million in consumer savings.

The rules also address critical minerals and battery component requirements, and the Foreign Entity of Concern restriction both of which were added to the clean vehicle credit by the IRA. These rules provide program integrity measures. The IRS said it would also conduct upfront reviews of documentation and certifications addressing material souring requirements to ensure manufacturers are accurately representing their battery contents.